You might encounter various terms and policies when considering life insurance options. The 10-year term life insurance, among these choices, garners popularity for those individuals who seek temporary coverage without committing to a lifelong policy. This article dissects the nuances of 10-year term life insurance policies intending to provide an in-depth comparison of diverse market-available options.

Policy Features and Coverage

10-year term life insurance policies tailor specific features and coverage options to the policyholders' needs. In addition to providing a standard death benefit, awarded upon the insured's demise within that stipulated time, all policies may differ in terms of supplementary benefits. For instance, some include riders like accidental death benefits. These offer an extra payout should the insured meet their end due to an accident. Individuals must understand these additional features to comprehensively assess the coverage offered by various policies. This understanding is essential.

Moreover, some term life insurance policies may impose exclusions or limitations despite providing coverage for death due to any cause during the agreed period. Specifically, they might not encompass deaths stemming from high-risk activities like extreme sports or hazardous occupations. Therefore, it remains crucial that policyholders meticulously scrutinize each policy's terms and conditions to confirm alignment with their lifestyle and requirements.

- Exclusions and Limitations: Some policies may have exclusions or limitations regarding coverage for specific causes of death, such as risky activities or pre-existing conditions.

- Additional Benefits: Certain policies offer riders accidental death benefits, providing extra financial protection in specific circumstances.

Premiums and Cost Factors

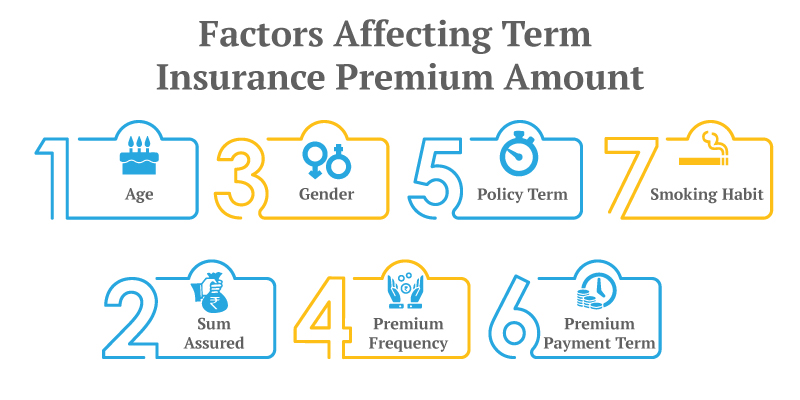

Various factors that insurers consider when assessing risk including age, health condition, lifestyle habits, and coverage amount determine the premium for a 10-year term life insurance policy. Non-smokers or those with healthy lifestyles may receive discounts or preferred rates from insurers. This serves as an incentive for policyholders to make healthier choices and adopt better behaviors.

Furthermore, individuals must actively acknowledge the possibility of premium escalations as time progresses. Although term life insurance premiums usually remain stable throughout the term's duration, certain policies might incorporate provisions for adjusting these premiums upon renewal. By comprehending such potential modifications in premiums, policyholders can effectively budget and circumvent future surprises.

- Potential Premium Increases: Some policies may have provisions for premium adjustments at renewal, potentially leading to increased costs.

- Discounts and Preferred Rates: Insurers may offer discounts or preferred rates for non-smokers or individuals with healthy lifestyles, resulting in lower premiums.

Underwriting Process and Requirements

The insurer actively engages in a thorough underwriting process for 10-year term life insurance. This involves an intensive evaluation of the applicant's health and lifestyle. Some applicants may experience a comprehensive medical examination. However, others could qualify, due to their health profile or medical history, for simplified underwriting. It remains crucial throughout this process that applicants furnish accurate, complete information. Such diligence mitigates potential discrepancies or delays in policy issuance.

Individuals possessing pre-existing health conditions or leading high-risk lifestyles may encounter obstacles while seeking affordable coverage. In these instances, the guidance of a proficient insurance agent or broker proves advantageous. They adeptly navigate the underwriting process and identify fitting coverage options, and critical support for those facing challenges in securing adequate protection.

- Accuracy of Information: Providing accurate and complete information during the underwriting process is crucial to avoid discrepancies or delays in policy issuance.

- Assistance from Insurance Professionals: Working with experienced insurance agents or brokers can help individuals navigate the underwriting process, especially those with pre-existing health conditions or high-risk lifestyles.

Flexibility and Convertibility Options

Policyholders in 10-year term life insurance policies can customize their coverage to cater to evolving needs and circumstances, thanks to the flexibility these plans offer. Certain insurers present options for adjusting coverage amounts or incorporating riders like critical illness or disability benefits throughout the policy duration. Further, by allowing policyholders a conversion option from their term policy into a permanent life insurance plan without necessitating further underwriting, this provides both long-term financial security and flexibility.

Furthermore, individuals must carefully review the terms and conditions related to policy changes and conversions. Conversion options may provide flexibility. However, they could also carry specific requirements or limitations. These might include deadlines for conversion--or even restrictions on available types of permanent policies.

- Policy Changes and Conversions: Reviewing the terms and conditions regarding policy changes and conversions is essential to understand any requirements or limitations.

- Rider Options: Some policies offer riders critical illness or disability benefits, providing additional financial protection against unforeseen circumstances.

Customer Service and Reputation

Selecting a 10-year term life insurance policy necessitates the consideration of an insurer's reputation and customer service, which crucially impacts the policyholder experience. To gauge reliability and trustworthiness, one should research aspects such as financial stability, customer reviews, and claims settlement processes pertinent to insurers. Furthermore, by reaching out to current policyholders or soliciting recommendations from trusted sources, individuals can effectively assess both the reputation of the insurer along its quality in rendering services.

Moreover, the insurer-policyholder relationship hinges on persistent customer support and communication. Throughout the policy term, a reputable insurer, one with responsive client service and an open claims process, instills peace of mind and confidence in its policyholders.

- Ongoing Customer Support: Choosing an insurer with responsive customer service ensures assistance and support throughout the policy term.

- Recommendations and Reviews: Seeking recommendations from current policyholders and researching customer reviews can provide insights into the insurer's reputation and service quality.

Conclusion

In conclusion, 10-year term life insurance policies offer temporary coverage. They present flexible options and competitive premiums. Understanding the features of these policies, along with their underwriting process, and premium rates, examining insurer flexibility and customer service will empower individuals to tailor an informed decision specific to their unique needs and financial state. Whether one seeks basic coverage or additional riders, comparison is paramount in this pursuit. It ensures that we secure not just any 10-year term life insurance policy but the optimal protection for peace of mind.