When considering purchasing a home, finding the right mortgage lender is crucial. Among

the multitude of options, Navy Federal and Wells Fargo stand out as reputable institutions offering various mortgage products. Understanding the disparities between Navy Federal and Wells Fargo mortgages is essential for potential homebuyers. This article will provide an insightful comparison between the two lenders, highlighting their differences in terms of eligibility criteria, loan options, interest rates, fees, customer service, and online tools.

Eligibility Criteria

Both Navy Federal and Wells Fargo have specific eligibility criteria for obtaining a mortgage. Navy Federal primarily serves members of the military, veterans, and their families, requiring membership to access their mortgage products. This membership requirement ensures that Navy Federal can offer specialized services tailored to the unique needs of military personnel and their families. On the other hand, Wells Fargo caters to a broader customer base, including individuals, families, and businesses. While Navy Federal's eligibility criteria are more focused, Wells Fargo provides opportunities for a wider range of borrowers, accommodating various financial profiles and backgrounds.

Navy Federal additionally designs special mortgage programs for their eligible membership base of first-time homebuyers. These initiatives frequently present lower down payment requirements and minimized closing costs, thereby offering further assistance to individuals making their initial home purchases. Wells Fargo, in contrast, provides comparable programs not only for military personnel and their families but extends this support to a wider audience as well. Thus, ensuring a diverse group of borrowers has increased accessibility to homeownership opportunities.

- Specialized Services for Military Personnel: Navy Federal's eligibility criteria cater specifically to military members and veterans, ensuring tailored services.

- First-Time Homebuyer Programs: Navy Federal and Wells Fargo offer programs tailored for first-time homebuyers, though with differences in eligibility requirements and benefits.

Loan Options

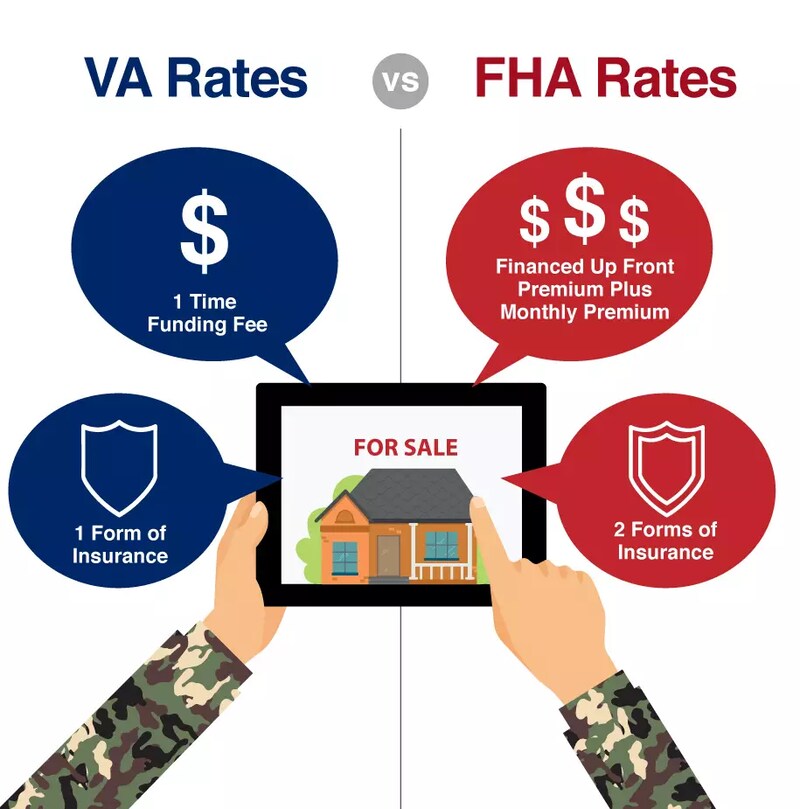

Navy Federal and Wells Fargo provide a diverse range of mortgage options, catering to varying financial situations and preferences. Specifically targeting military members and veterans, Navy Federal offers conventional loans, VA loans, and FHA loans. They also cater jumbo loan services. This array of loan products empowers borrowers in selecting the most suitable option for their specific needs, accommodating individualized financial circumstances effectively. Navy Federal's VA loans frequently offer competitive terms and favorable interest rates. This accessibility to homeownership particularly benefits military personnel along with their families.

Contrarily, Wells Fargo presents a vast array of mortgage products such as conventional loans, FHA loans, VA loans, jumbo loans, and specialized programs tailored for first-time homebuyers. The breadth of their selection imbues borrowers from diverse backgrounds and financial situations with flexibility and options. Moreover, Wells Fargo bolsters these offerings with dedicated initiatives such as down payment assistance, plus other incentives, to promote homeownership specifically among low-income individuals and those venturing into property acquisition for the first time.

- Competitive Terms for VA Loans: Navy Federal's VA loans often feature competitive terms and favorable interest rates, providing additional benefits to eligible borrowers.

- Extensive Selection of Mortgage Products: Wells Fargo's wide range of mortgage products offers flexibility and options for borrowers from diverse financial backgrounds.

Interest Rates

Comparing interest rates is paramount when choosing between Navy Federal and Wells Fargo mortgages. Interest rates can significantly impact the overall cost of homeownership and monthly mortgage payments. Navy Federal and Wells Fargo may offer competitive interest rates, but they can vary depending on factors such as credit score, loan term, and market conditions. Conducting thorough research and obtaining personalized rate quotes from both lenders can help determine which institution offers the most favorable interest rates for your mortgage.

Furthermore, borrowers should consider the potential for interest rate fluctuations and choose a mortgage product that provides stability and predictability. Fixed-rate mortgages offer consistent monthly payments throughout the loan term, while adjustable-rate mortgages (ARMs) may feature lower initial rates but can fluctuate over time. Understanding the pros and cons of each type of mortgage can help borrowers make informed decisions based on their financial goals and risk tolerance.

- Stability of Fixed-Rate Mortgages: Fixed-rate mortgages offer consistent monthly payments, providing stability and predictability for borrowers.

- Consideration: Borrowers should weigh the potential for interest rate fluctuations when choosing between fixed-rate and adjustable-rate mortgages.

Fees

In addition to interest rates, borrowers should consider the fees associated with Navy Federal and Wells Fargo mortgages. These fees may include origination fees, appraisal fees, closing costs, and other charges. While both lenders disclose their fee structures, the specific fees and amounts may differ between Navy Federal and Wells Fargo mortgages. Understanding the fee schedule of each lender and calculating the total cost of borrowing is essential for making an informed decision and avoiding any unexpected expenses during the mortgage process.

Borrowers should inquire about potential opportunities to negotiate or reduce certain fees. Some lenders may offer incentives or discounts, especially for borrowers with excellent credit or those who opt for certain mortgage products. Additionally, borrowers should be aware of any prepayment penalties or recurring fees that may apply throughout the life of the loan. By thoroughly reviewing the fee structure and discussing options with the lender, borrowers can minimize upfront costs and ensure transparency in their mortgage agreement.

- Opportunities: Borrowers should inquire about opportunities to negotiate or reduce certain fees, potentially saving on upfront costs.

- Awareness: Borrowers should be aware of any prepayment penalties or recurring fees that may apply throughout the life of the loan, ensuring transparency in the mortgage agreement.

Customer Service

Navy Federal and Wells Fargo's mortgage experience significantly hinges on the customer service quality. Renowned for its personalized service, Navy Federal provides dedicated support to military members and their families. Their representatives possess knowledge about VA loans, comprehending the unique needs of military borrowers. Specialized expertise guarantees that military personnel receive tailor-made guidance and support at every stage of the mortgage process, from application until closing. It reflects a commitment to their unique needs.

Equally emphasizing customer service, Wells Fargo offers a multitude of assistance channels such as in-person consultations, phone support, and online resources. Their meticulously trained customer representatives handle inquiries with precision and guide borrowers through each phase of their mortgage journey. Furthermore, the extensive network of branches maintained by Wells Fargo enables borrowers to enjoy direct access to in-person support, a factor that significantly enhances the overall customer experience.

- Specialized Expertise: Navy Federal's representatives are knowledgeable about VA loans, providing tailored guidance and support to military borrowers.

- Extensive Network: Wells Fargo's extensive network of branches allows borrowers to access in-person support and assistance, enhancing the overall customer experience.

Online Tools

Navy Federal and Wells Fargo, both offer online tools and resources to streamline the mortgage application process, specifically, provide a user-friendly website. In addition, they offer convenience through their mobile apps. Members of these institutions can use this digital platform for multiple purposes, applying for mortgages, tracking application status, and managing accounts online, all with an emphasis on accessibility. It allows borrowers not only to complete tasks but also access to information at any time from any location.

An array of digital tools, such as mortgage calculators, educational resources, and online account management features, is also offered by Wells Fargo. These empower borrowers to make informed decisions, possess an enhanced understanding of mortgage options, and ensure effective financial management. Furthermore, Wells Fargo's online platform might integrate interactive features with educational content. This strategic combination not only steers borrowers through the complex mortgage process but also illuminates them with invaluable insights into homeownership.

- Interactive Features and Educational Content: Wells Fargo's online platform may include interactive features and educational content to guide borrowers through the mortgage process and provide valuable insights into homeownership.

- Accessibility and Convenience: Navy Federal's user-friendly website and mobile app offer convenience and accessibility, allowing borrowers to complete tasks and access information anytime, anywhere.

Conclusion

In conclusion, choosing between Navy Federal and Wells Fargo mortgages requires careful consideration of various factors, including eligibility criteria, loan options, interest rates, fees, customer service, and online tools. By comparing the offerings of both lenders and evaluating how they align with your financial goals and preferences, you can make an informed decision and secure the right mortgage for your home purchase.